In a previous blog, I modelled the superannuation contributions of a full-time employee earning $60,000 a year. This employee retires with a superannuation lump sum of $1.1 million

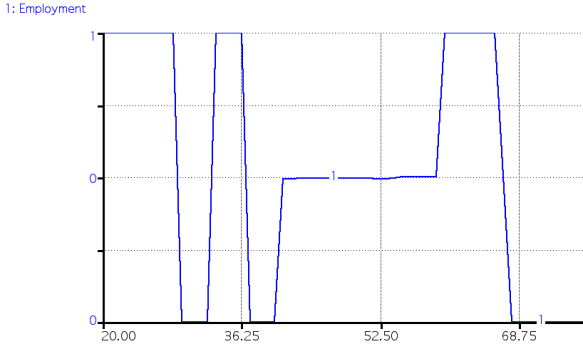

In the first section of this blog I will model a female employee on $60,000 a year who works full-time until she is 29 and when she takes four years off to have her first child,

She returns to work full-time for two years, then takes another four years off when she turns 35 to have a second child. She then returns to work half-time until she turned 60 when she returns to work full-time, in order to boost to superannuation savings, until her retirement at 65.

This is what her employment history looks like in graphical form

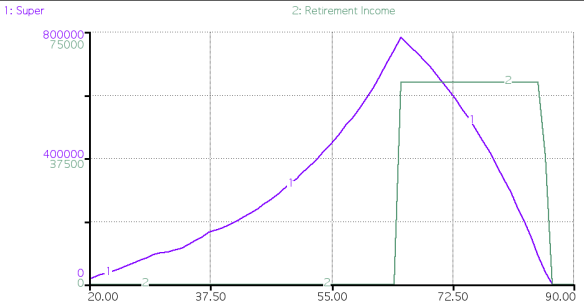

At retirement, her lump sum is $780,000, just over 70% of the lump sum of a full-time employee.

The huge advantage of the current scheme is that, for the female employee, her superannuation fund continues earning interest during the periods when she is not working.

However her employment pattern has significant implications for \ her retirement income. You can see the details of the retirement income of the full-time worker in this blog.

On retirement, she can draw down $60,000 a year until she is 85 when her superannuation will run out.

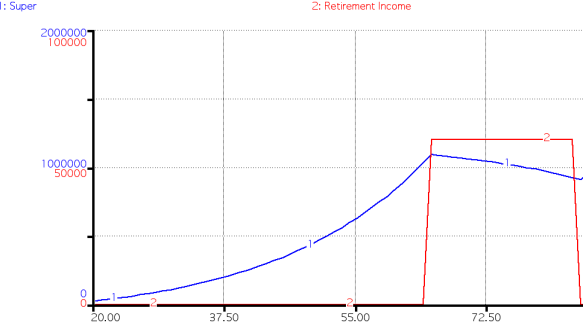

While $60,000 year compares well with her final post-tax salary of $53,000, she is in nothing like the position of the full-time employee whose superannuation lump sum declines only slightly after retirement. When the retiree dies at the age of 85, there is still has $908,000 in his superannuation account. This can become part of his estate and passed on to the children.

This is a luxury that the female superannuation does not have, given her employment history.

If the full-time employee wishes to leave nothing in the superannuation fund and assumes he will die at 85, he can draw a retirement income of $87,000 a year. That’s 34,000 tax-free dollars more than his working income of $54,000 and $27,000 more than a female employee with a different work pattern.

If there is to be a debate about whether superannuation contribution rates should be 9.5% or 12%, it also needs to be a debate about how the superannuation savings of women who choose to move in and out of the workforce or to work part-time, can be supplemented.

One thought on “How women are disadvantaged in the superannuation system”

Comments are closed.